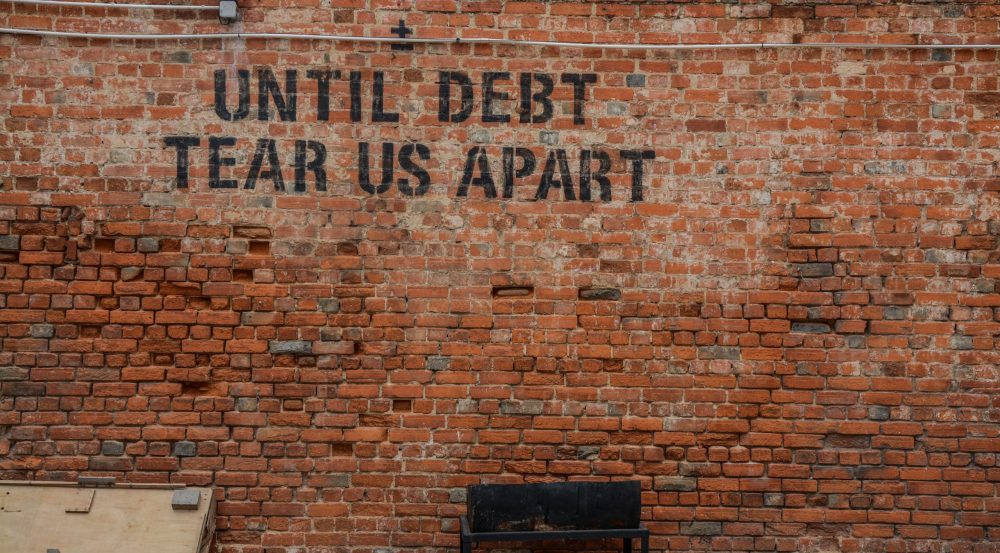

Sexually Transmitted Debt (STD) in the Family Law world

There is a different kind of STD going around, perhaps not the type of STD you are thinking of, however it can be caught in a similar manner to the common dose of chlamydia.

There is a different kind of STD going around, perhaps not the type of STD you are thinking of, however it can be caught in a similar manner to the common dose of chlamydia.

So, what is this common plague that can potentially affect us if we do not take all measures to protect ourselves from catching it? Sexually Transmitted Debt (STD) is when you become liable for your partner’s debt as a result of the breakdown of your marriage or de facto relationship, rather than a conscious knowledge or acceptance of the debt. Examples can include:

- Overspending on a joint credit card.

- Taking out a loan or guaranteeing a loan on behalf of a partner.

- Unauthorised withdrawals on a mortgage account.

- Incurring debts during the relationship such as non-payment of a tax liability.

Why should I be made liable for my partner’s debts?

If you have joint debt with your partner and there is a failure to make payment of that debt, then you will be liable to make payment of the debt. The most common reasons you will be responsible for someone’s debts are:

- if you signed a guarantor agreement;

- you have a joint account; or

- you opened an account for someone else in your name.

Generally speaking, you will only have to pay your spouse’s debt on joint accounts. So, if you have a joint credit card, bank account or mortgage you will be liable for the entire debt in the event of a relationship breakdown.

What can you do to prevent an STD?

- USE PROTECTION. Keep separate bank accounts. If you must have a joint account for paying joint bills, holiday savings, etc, ask your bank to set the joint account up to require both parties to authorise withdrawals from that account.

- TALK DIRTY. Do not assume you are on the same page as your partner when it comes to your debts. Clearly communicate to your partner what liabilities you are responsible for.

- USE EVEN MORE PROTECTION. Employ the protection of a lawyer. Do not sign anything without obtaining independent legal advice.

- TAKE CONTROL. Do not become a secondary holder on a credit card if the primary holder is unable to financially take responsibility for the debt. If you are unsure whether you are a guarantor or joint account holder it is important that you speak to your lender. The account will have your signature and that of anyone else who is responsible. You should also check whether you have made any written or verbal agreements for another’s debts.

You will have to pay your spouse’s debt if you are a guarantor or joint account holder if they default on payments or pass away. However, if no liability exists, you will not have to pay any debt regardless of your relationship with them. Even if you used your spouse’s accounts as an additional card holder, you are not liable if your signature or another agreement is missing. If you and your partner separate, joint debts remain legally binding. If one partner fails to pay, the creditor will ask the other to cover the debt. However, if your ex-spouse refuses to make their share of the payment, you can take them to Court. It is recommended that you end any shared accounts and joint debts when you separate to avoid such instances arising.

In summary…

You are only ever accountable for a debt you agree to pay. If your partner is in debt you may wish to help however if you separate, or your spouse passes away, you are not responsible for their debt. The only instances where you are legally bound to pay are:

- for joint accounts; or

- where you have signed as a guarantor.

If you need assistance or clarification in determining whether or not you are responsible for your spouse’s debt, please obtain independent legal advice from an experienced legal practitioner.

Tindall Gask Bentley is here to assist you. Please contact your nearest TGB office – we have offices located in South Australia, Western Australia, the Northern Territory and Queensland.