Separation – Are Family Trusts Fair Game?

A common misconception amongst new clients is that they can construct a Family Trust in which to ‘squirrel away’ assets (including properties) on the basis that the Family Trust will not be captured as part of the parties’ net asset pool.

A common misconception amongst new clients is that they can construct a Family Trust in which to ‘squirrel away’ assets (including properties) on the basis that the Family Trust will not be captured as part of the parties’ net asset pool.

Unfortunately, this is exactly that – a misconception – and this article will demonstrate why.

What is a Family Trust?

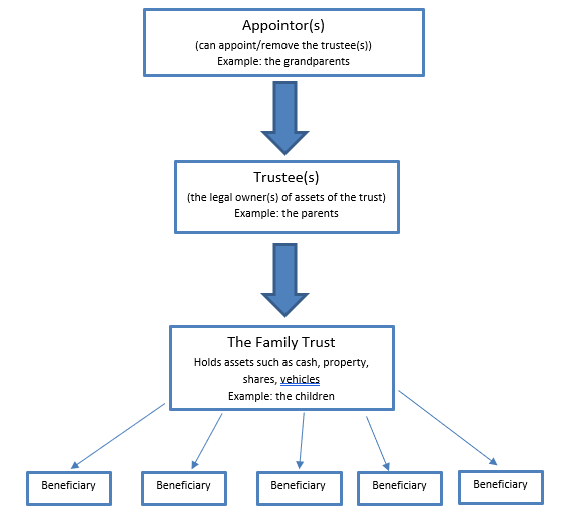

A Family Trust is a discretionary fund that holds (sometimes very valuable) family assets and distributes any income received from those assets to the Family Trust’s beneficiaries, who are commonly children, spouses, siblings, nieces and nephews and/or grandchildren.

For example, the most commonly structured Family Trust is as follows:

Disclosure Process

The Federal Circuit and Family Court of Australia is aware that some parties may attempt to hide their wealth in a Family Trust, as they regularly see this attempted in matters that come before the Court.

There are specific rules about ‘full and frank disclosure’ in financial cases which require each party to disclose their total direct and indirect financial circumstances in accordance with Rule 6.06 of the Federal Circuit and Family Court of Australia (Family Law) Rules 2021.

Under this Rule, parties need to disclose all sources of earning, interest, income, property and other financial resources, and the rule applies regardless of whether the property, financial resources and earnings are held in corporations, trusts, a company or other similar structures.

As a result of Rule 6.06, each party must provide full disclosure of any current or future interest in a Family Trust. A failure to disclose the Family Trust may result in a breach of that party’s disclosure obligations.

Should the Assets in the Family Trust be part of the Net Asset Pool?

In considering whether the Family Trust will form part of the parties’ net asset pool, the Court needs to determine who is in effective control of the Family Trust. For example, if the Court considers that a party is making a majority of the decisions of the Family Trust (such as managing the rental income from a property owned by the Family Trust), then it is likely that the assets of the Family Trust will form part of the parties’ net asset pool.

On the other hand, the Court may decide that the Family Trust assets do not form part of the parties’ net asset pool, but instead that they are considered as a ‘financial resource’.

Because most Family Trusts are income generating, the access by a party to that income generating resource in the future is likely to be factored in as part of that party’s property settlement process with their former partner.

Here are two examples that illustrate these two possible scenarios:

Example 1

The husband (Party 1) is a director of a company that owns property for and on behalf of a Family Trust. He makes decisions in relation to the property’s generation of income as well as the distribution of that income to the beneficiaries of the Family Trust.

In the circumstances of this scenario, the assets held by Party 1’s Family Trust are likely to form part of his net asset pool with his former partner.

Example 2

The daughter (Party 2) of wealthy parents is a beneficiary, together with her siblings, of her parents’ Family Trust. She does not have any control over the acquisition and/or disposal of the assets held by the Family Trust, nor does she have a say in the distribution of any income earned by the Family Trust.

Under the circumstances of this scenario, Party 2’s interest in the Family Trust is likely to be classified as a ‘financial resource’ in her property settlement with her former partner.

Get in touch

If you have separated or are thinking of separation and you wish to discuss any interest you may have in a Family Trust further, please contact our friendly Family Law Team, fill out this enquiry form or call 1800 730 842 to speak with one of our family lawyers.