Is a testamentary trust right for you?

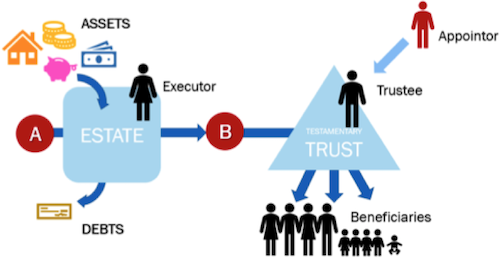

First things first, what is a trust? A trust is an arrangement which lets a person or company, known as the trustee, hold property or assets for the benefit of others, known as the beneficiaries. A 'testamentary trust' is a trust established in a Will.

First things first, what is a trust? A trust is an arrangement which lets a person or company, known as the trustee, hold property or assets for the benefit of others, known as the beneficiaries. A ‘testamentary trust’ is a trust established in a Will.

Incorporating a testamentary trust in your will involves the preparation of a more complex and comprehensive will; however there are a number of significant benefits for your beneficiaries. These benefits fall into two primary categories: Asset Protection and Tax Benefits.

Asset Protection

When you leave a legacy directly to one of your beneficiaries, that legacy can be made available to any person who makes a claim against the beneficiary. This can include claims by:

- Creditors – if your beneficiary is experiencing financial hardship e.g. Bankruptcy;

- Claimants – if your beneficiary is being sued e.g. For professional negligence or a breach of contract;

- Family members – if your beneficiary is in the midst of family court proceedings.

Whereas if you leave the legacy to your beneficiary in a testamentary trust, the assets can be safeguarded against such claims and less accessible to claimants as the assets are held by the trustee of the trust, not the beneficiary.

In addition to the above, the establishment of a testamentary trust in some circumstances can protect the legacy from the beneficiary themselves. This is best illustrated by example:

- The testator has three children and wishes to benefit them equally under their Will; however one child has a problem with substance abuse or gambling addiction. A testamentary trust can be established for the child with the addiction, whereby they receive 1/3 of the estate on trust, and a trustee is appointed to protect and manage those funds ; or

- The testator wants to leave a legacy for a beneficiary who is a minor or an individual who suffers from a disability. Again, a testamentary trust can be established for that individual, whereby they receive 1/3 of the estate on trust, and a trustee is appointed to manage those funds.

Tax Benefits

Income received by minor children from an ordinary trust, such as a family trust, is taxed up to 45cents in the dollar. However, incomes received by minor beneficiaries from a testamentary trust are eligible for the adult income tax concession, that is they can receive up to $18,200.00 tax free.

This means that a beneficiary can make tax effective distributions to a wide range of beneficiaries of the trust, including minor children, and receive the funds out of the trust – tax free.

There are also Capital Gains Tax (CGT) benefits of receiving property via a testamentary trust, rather than as an outright gift. Whilst generally there is no CGT payable upon the transfer of a property from the trustee of a testamentary trust to a beneficiary, the liability for CGT is triggered when the beneficiary who received the asset subsequently disposes of it. The trustee can by transferring the asset to a beneficiary on a limited or nil income reduce the CGT liability. Also by holding the assets of an estate within a trust presents the beneficiaries with an opportunity to defer the need for the sale of assets and the incurring of CGT.